COP26: Funding sustainable change

Energy Observer | Wind Farm

Climate change is the greatest emergency we are facing nowadays. The past decade was the hottest ever. Extreme natural events occur more frequently, more intensely and less predictably: fires, storms, droughts, floods and air pollution are intensifying around the world damaging homes and affecting the livelihoods and the health of millions of people, endangering communities and natural habitats and widening the gap between rich and poor.

The consequences of a non-environmentally sustainable global economy are devastating for communities and individuals and despite we are working tirelessly to tackle these tolls and reduce emissions, further changes in the climate will inevitably occur.

Limit climate change

There are two ways we can deal with a changing climate: mitigation and adaptation.

The former aims at acting at the source point, by lowering greenhouse gas (GHG) emissions for instance; and that represents the first goal of COP26, which asks countries to come up with ambitious 2030 emissions reductions targets to secure global net zero by the middle of the century.

The latter consists in covering all that part which cannot be solved by mitigation measures, and thus reducing the negative consequences of a changing climate. This is also among the objectives of COP26 and it goes hand in hand with the need of protecting and restoring ecosystems and building defences and resilient infrastructures.

All this costs money -a lot of money- and here is exactly where low-income countries need support.

Improving yes, but not fast enough

The 2015 COP21 in Paris was a key turning point that raised awareness on the urgency of limiting global warming to 1.5°C above pre-industrial levels with the goal of tackling climate change and averting its catastrophic consequences. In that occasion, countries pledged to submit the so called Nationally Determined Contributions (NDCs), namely national plans stating their emissions reduction commitments and representing the basis underpinning the achievement of long-term objectives.

In a nutshell, NDCs are a way each country outlines and communicates every five years its own post-2020 climate actions and thus a measure to determine whether the world is achieving the COP21 goals of reaching a peak in GHG emissions as soon as possible and implementing drastic reductions thereafter.

Six years have passed since then, and we have indeed made progress to limit the rise in temperatures close to 2°C and that’s the good news. The bad news is that we are not doing it fast enough and that -as scientists say- much more must be done to limit the global temperature rise to 1.5 °C, halve emissions and secure global net-zero by 2050.

The United Nations Climate Change Conference of Parties (COP26) happens at the perfect time, gathering every nation with the goal of coming to an agreement on how to combat climate change and join forces to avoid this crisis.

The $100 billion broken promise

The world population is rapidly growing and will keep on doing it in the next 30 years: we were 6.9 billion in 2010, 7.8 in 2020 and this number is expected to be around 9 billion in 2040. This massive growth will have significant impacts on natural resources and energy needs, which will translate -if we continue the way we do- into increased emissions, higher temperatures and more severe climate consequences.

As world leaders and climate activists rally in Glasgow, focus turns -among other important topics- to climate finance, which is gaining momentum both as an objective and a means to achieve the other goals. To deliver on the first two goals of COP26 (ensure net zero emissions by mid-century and adapt to protect vulnerable communities and natural habitats) and face an exponential population growth, a brand-new energy system must be conceived, from production to end-use, and together with it a radical restructuration of our economies must be envisaged.

We need a transition to a greener and cleaner economy to guarantee a more climate-resilient world and we need it now.

Addressing climate change is expensive and critical for poorer countries, which are the hardest hit and the least responsible for greenhouse gas emissions. They just cannot afford billions of dollars to transition to a low-carbon economy and adapt and mitigate the impacts of a changing climate. Here finance comes into play, following the “common but differentiated responsibility and respective capabilities” rationale, as an economic and moral imperative of wealthier countries to provide poorer countries with better assistance.

During COP15, in 2009, wealthier nations committed to mobilising thanks to the collaboration of governments, multiliterate development banks and private entities a joint grant of $100 billion each year by 2020, with the aim of supporting underdeveloped countries in their green transition.

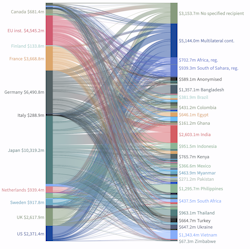

So far, the annual goal has never been even remotely hit: in 2019, the mobilised climate finance totalled $79.6 billion, being still $20 billion short of the target.

Figure 1. Climate finance flows, yearly average in 2015 and 2016

How much do we actually need?

Of the money transferred to developing countries in 2019, around $20 billion went into adaption projects, around one third of the funds for mitigation projects. However, according to the Adaptation Gap Report 2020 of the UN Environment Programme, being adaptation the most pressing issue for developing countries, they would need much more (around $70 billion per year) than just 20% of the total capital for adaptation measures.

Moreover, when compared to the investment required to avert the hazardous effects of a global warming, the $100 billion commitment is miniscule. We would need trillions of dollars to fulfil the below 1.5°C target: according to an IPCC report, we are talking of $2.4 trillion (around 2.5% of the world GDP) that need to be invested every year through 2035 in the energy system alone.

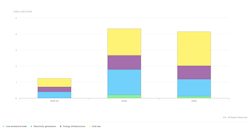

Therefore, it is essential to bring investments in the energy sector – which significantly dropped during the COVID-19 pandemic- back to at least pre-pandemic levels and focus the financing on everything that enables a clean transition and a decarbonization of all sectors: energy efficiency, renewables, storage methods, smart grids, low-carbon technologies, new fuels. According to the International Energy Agency (IEA) report "Net zero by 2050", these fundings are rated at around $4 trillion per year: more than three times what the world invests today.

Clean energy investment in the net zero pathway, 2016-2050

That’s the reason why all forms of finance are crucial to accelerate the transition to net zero, reduce vulnerability and enhance the resilience of ecosystems to climate change damages: public finance to develop infrastructure and private finance to fund and speed up technology and innovation.

Precisely in this regard, the Glasgow Financial Alliance for Net Zero -an international coalition of private financial institutions, gathering the world’s biggest banks, insurers and investors- just pledged $130 trillion to hit the net zero goal. That leaves us hopeful if these funds will support a truly green transition.

It is easy to focus on how much money is available, but just as important is understanding where all this money is spent, on which projects and for which measures.

The greatest part of CO2 emissions reduction by 2030 is due to already existing technologies but in the years to come the ones which we will rely on will be those that are now at lab or pilot stage and that will by then be demonstrated and scaled. Here is where we need financing.

Moreover, net zero cannot happen if we keep on funding fossil fuels projects. Coal, oil and gas need to be phased out from our energy mix, being progressively replaced by green and sustainable alternatives, no investment should go to new coal-fired power plants, companies should stop selling new internal combustion engine cars, great emitters should be penalised by higher carbon pricing. Here is where we need policies.

It is therefore essential that countries commit to climate regulatory efforts and that they do it at a global scale so that private investments can be steered in the right direction and in a transparent way, taking into account their own environmental footprint.

Tackling climate change is a great challenge and requires immense efforts -it is undeniable and we all know that- but if everyone does their bit and public and private sectors join forces to guarantee the financial means, it will definitely pay off, bringing significant economic benefits in a world coming out of a pandemic, creating millions of jobs and providing among other benefits universal access to electricity and widespread well-being.

Wind farm in Marie-Galante, Guadeloupe

To go further

Forbes - IEA: 5 Ways For Finance To Accelerate The Net-Zero Clean Energy Transition

Carbon brief - Interactive: How climate finance ‘flows’ around the world

Forbes - The $100 Trillion Investment Opportunity In The Climate Transformation

COP - COP26 Explained

FAO - The state of the World's Forests

Vox - Why restoring nature is so important to limiting climate change